Editor’s Note: The following is an article originally published on the College Fix on July 14, 2025. With edits to match Minding the Campus’s style guidelines, it is crossposted here with permission. The One Big Beautiful Bill that President Donald Trump signed into law on July 4 caps how much money graduate students can borrow from the federal […]

Read More

One of the best parts of the higher ed portion of the reconciliation bill being pushed in the House of Representatives is a shift from cost of attendance (COA) to median cost of attendance (MCOA). What is the Cost of Attendance and Why Does It Matter? COA is the total cost of attending college, including […]

Read More

When people ask me, “What is the worst thing the federal government has done regarding higher education,” I say it is a close call between two policy blunders: its entering the student loan business for college students, and the creation of the U.S. Department of Education (ED). But if forced to choose, I would say […]

Read More

Shifting student loans from the current government-as-lender model to the private market would be beneficial. As I recently reported, this shift would reduce malinvestment—educational spending that doesn’t justify its costs—while increasing accountability for colleges, improving incentives for both students and institutions, and fostering more informed decision-making through price differences. But privatization is a broad bucket. […]

Read More

When you graduate and get your first job, seeing the money rolling into your bank account feels momentous. After years of scrimping and saving, you finally have a positive bank balance to spend on something other than your tuition fees, rent, groceries, or nights out. While graduating is a big milestone and can feel like […]

Read More

Republicans have their best opportunity in decades to significantly reform or even eliminate government involvement in student loans. As I explain in a new Cato Institute paper, doing so could generate up to $212 billion in savings over the next ten years. But Congress needs to act quickly as the window of opportunity will close […]

Read More

With the elections in November giving Republicans small majorities in the House and Senate, there is considerable attention on potential reconciliation bills with pros and cons relative to regular legislation for the new Republican majorities. On the bright side, reconciliation bills cannot be filibustered, which means that they only need 51 votes rather than the […]

Read More

Most of the problems with student loans are due to a misalignment of incentives. There are three parties to a student loan: the student, the lender—meaning the federal government because we use a government-as-lender system—and the college. A good student loan system would align the incentives so that no party can benefit by making the […]

Read More

While the Biden administration has at least nine plans to forgive student loans, some are much bigger than others. And the two biggest have now run into legal buzzsaws. The Supreme Court (SCOTUS) eventually threw out its first plan in 2022. The second plan introduced a new income-driven repayment plan called SAVE, which, in practice, […]

Read More

Editor’s Note: This article was originally published by Liberty Unyielding on April 10, 2022, and is republished here with permission. Joe Biden has provided billions of dollars in handouts to high-income people. The most recent example is his administration’s decision last week to suspend student loan repayments yet again, through August 31. It did that even though people with big student loans tend […]

Read More

Mass student debt forgiveness is unpopular with Republicans and even some Democrats. As such, it’s unlikely that the Biden administration will forgive all $1.45 trillion in student loan debt prior to the midterm elections. But that hasn’t stopped unelected bureaucrats in the administration from working behind closed doors to forgive massive amounts of student loans […]

Read More

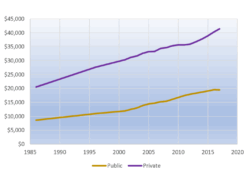

Conservatives have long worried about the Bennett Hypothesis. Named for former Education Secretary William Bennett, it argues that the availability of federal financial aid programs leads colleges to increase tuition faster than they otherwise would. Conservatives have been right to worry. But there’s a way to break that link—by changing how we determine aid eligibility. […]

Read More

Skin in the game for student loans, the idea that colleges should face financial consequence when their students default, is gaining momentum in policy discussions. After all, when students take out loans, the colleges get all their money upfront, leaving taxpayers holding the bag when students default on the loan payments years later. It seems […]

Read More

Senator and Presidential hopeful Elizabeth Warren (D, MA) recently proposed a policy to cancel student loan debt. She wants to cancel up to $50,000 of debt for borrowers with annual household incomes under $250,00, including full cancellation for households with incomes under $100,000. It would be financed with an “Ultra-Millionaire Tax” – a massive redistribution […]

Read More

Stealing from Shakespeare: “Let’s kill all the accreditors.” In this kinder and gentler age, most of us would be content if college accreditors simply resigned their positions and did something useful, such as selling cars. When you buy a car, you pay about the same as a year’s tuition fee at a good university. Yet […]

Read More

Federal efforts to alleviate the high and rising cost of attending college through student loans have morphed from a policy challenge to a fiscal time bomb threatening to blow up the financial future of tens of millions of Americans and the government’s own solvency. Dressed up as a progressive achievement, it is actually a failure […]

Read More

What’s to be done about the large and growing number of Americans who cannot repay their student loans? There are two new developments. The New York Times reports, “Senators Marco Rubio and Elizabeth Warren introduced a bill on Thursday that would prevent states from suspending residents’ driver’s licenses and professional licenses over unpaid federal student […]

Read More

More and more Americans are going on to post–high school education, encouraged to do so by both governments and nonprofit organizations. According to the U.S. Department of Education, for example, “In today’s world, college is not a luxury that only some Americans can afford to enjoy; it is an economic, civic, and personal necessity for […]

Read More

Nearly a decade ago, my then colleague Andrew Gillen suggested that one could say that higher education was in a bit of a “bubble”: over-exuberant “investors” in human capital, better known as students, were potentially misallocating their resources, becoming increasingly underemployed after graduation, leading to adverse financial consequences. In the private sector, bubbles, like those […]

Read More

Exceptional athletes are often called game changers, but the real game changers in sports are the committees that set the rules. Changing the height of the pitcher’s mound changes the game. So too with expenses in higher education. The rules are changing. The House of Representatives has passed a tax reform bill that includes several […]

Read More

Three-year bachelor’s degrees are back in the news mostly because colleges and universities are coming under heavy pressure to make higher education more affordable. Last month New York University, one of the most expensive schools, launched its “NYU Accelerate,” which officials called “a new program that outlines pathways to make it easier for some students to […]

Read More

Conventional wisdom says that expansions in federal student aid will result in a more affordable and equitable post-secondary education system. While this belief has motivated massive expansions of federal aid in the recent past, rapidly increasing tuition and student loan default rates are raising questions about this approach. In a new study, I review the […]

Read More

The federal government happily subsidizes inferior state colleges that graduate few if any of their students. That includes Chicago State University, which has a 12.8 percent six-year graduation rate. The Obama administration has rewritten federal student loan rules in a way that encourages colleges to raise tuition and effectively subsidizes the worst colleges the most. The Federal Reserve Bank of […]

Read More

Connecticut is going through the motions of trying to tax Yale’s $25.6 billion endowment to help relieve the state’s $266 million shortfall. That effort will fail, but public opinion is starting to question the appropriateness of government-conferred tax benefits for university endowment funds. At Harvard, alumni as politically diverse as conservative Ron Unz and progressive […]

Read More

By Peter Wood In 2014 Senator Marco Rubio lent his support to CASA, the Campus Accountability and Safety Act—the effort by Missouri Senator Claire McCaskill and New York Senator Kirsten Gillibrand to strip the due process rights of students accused of sexual assault. The bill died that year but McCaskill and Gillibrand brought it back […]

Read More

For the past two autumns the two leading academic reform organizations, the National Association of Scholars (NAS) and the American Council of Trustees and Alumni (ACTA), have held events offering high praise to the liberal arts as a means to improve students’ writing and to provide them with the classical culture that Mathew Arnold calls […]

Read More

Nearly everyone recognizes that student debt has risen to a level that will be difficult to sustain in the future given the nation’s slow growing economy and the sagging incomes of too many college-educated Americans. Nearly 40 million Americans are carrying some form of student debt; more than 7 million are in default on their […]

Read More

Writing in The New York Times, Lee Siegel encourages students to follow his example and default on their student loans. The four biggest problems with his piece are: Siegel is the wrong case study Even if you are of the opinion that college should be free and student debt is immoral, Siegel is the wrong […]

Read More

By Diana Furchtgott-Roth, Jared Meyer This month, as 1.8 million newly minted bachelor’s degrees are handed out, most graduates will be coming off the stage with much more than a fancy piece of paper. Seventy percent will take an average of $27,000 in student loan debt with them as they try to build their careers after college. This […]

Read More

• Campus Reform asked out-of-state students at UVA and UMD if they would be willing to give up their U.S. citizenship to become “undocumented students.”

• Out-of-state students at both universities pay nearly twice as much as in-state students and illegal immigrants pay.