The federal dollar chain is an important civics lesson for college students. It will help answer, “Can I expect to receive Social Security payments? And will the United States of America go bankrupt?” The federal dollar chain is at least seventy-five years long. It is a conceptual tool that begins with taxes paid today by […]

Read More

Editor’s Note: This article was originally published by Liberty Unyielding on April 10, 2022, and is republished here with permission. Joe Biden has provided billions of dollars in handouts to high-income people. The most recent example is his administration’s decision last week to suspend student loan repayments yet again, through August 31. It did that even though people with big student loans tend […]

Read More

Mass student debt forgiveness is unpopular with Republicans and even some Democrats. As such, it’s unlikely that the Biden administration will forgive all $1.45 trillion in student loan debt prior to the midterm elections. But that hasn’t stopped unelected bureaucrats in the administration from working behind closed doors to forgive massive amounts of student loans […]

Read More

The Department of Education is going to forgive an additional $6.2 billion in student loans for 100,000 students through the Public Service Loan Forgiveness program. This adds to the $1 billion in previously forgiven loans for 11,000 students. This shows one of the reasons why student loan forgiveness is such a bad idea. Under the […]

Read More

Originally posted at Open Market The Washington Times takes note of the burgeoning higher education bubble in a recent editorial: The cost of a college education has soared far in excess of the cost of health care. This is in spite of — or, more accurately, because of — massive government involvement in subsidizing […]

Read More

How do you reduce the growing mountain of student loan debt? Stop subsidizing higher education? End the notion that ‘any degree’ is better than ‘no degree’? Teach kids that paying off $12,000 in loans isn’t a cakewalk? No, no, let’s just tell them again how much it costs and hope they make the best of […]

Read More

A Wall Street Journal editorial today took a very negative view–rightly, in my opinion–of President Obama’s proposal to let student borrowers discharge private student loans through bankruptcy. By law, repayment of federally guaranteed loans cannot be avoided this way. But the Journal wrote: “If there’s not a great outcry over letting borrowers stiff private lenders, eventually […]

Read More

Over at NRO yesterday Jay Hallen proposed a few solutions to easing the student-loan bubble. Though his impulses are correct his recommendations fall flat. Hallen first proposes that the Department of Education move to a “risk-based pricing” system in which it would consider a student’s high-school GPA or intended major in determining the loan price. […]

Read More

The new Sallie Mae-Gallup survey of attitudes toward higher education, “How America Pays for College 2012,” shows that Americans are becoming increasingly resistant to rising college prices. Some people who were saying “I want the best college money can buy” a few years ago, are now saying “We aren’t going to pay sky-high tuition when […]

Read More

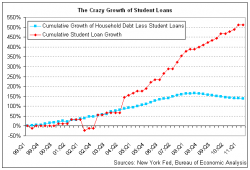

From MyBudget360, a sobering reminder of explosive student loan growth:

Read More

When asked the question, “Why do colleges keep raising tuition fees?” I give answers ranging from three words (“because they can”), to 85,000 (my book, Going Broke By Degree). Avoiding both extremes, let’s evaluate two rival explanations for the college cost explosion, followed by 12 key expressions that add more detail.

Read More

Carol Todd of Nottingham, Maryland, persuaded a bankruptcy judge in Baltimore to “discharge”–that is, wipe the slate clean on–nearly $340,000 in student loan debt. The grounds were that she has Asperger’s Syndrome, a mild form of autism that apparently prevents her from getting or keeping a steady job. U.S. Bankruptcy Judge Robert Gordon ruled on […]

Read More

On May 18, both the Chronicle of Higher Education (here) and Inside Higher Ed (here) discussed a new report from the University of Southern California’s Rossier School of Education arguing that student debt has a disparate impact on Latinos.

Read More

When Victor Hugo claimed that all the world’s armies are powerless against an idea whose time has come, he probably had in mind good ideas. But the time can come for a bad idea also. Low-cost student loans, embraced by President Obama, Governor Romney, and Congressional leaders of both parties, is a bad idea. Students […]

Read More

No modern-day Paul Revere is taking a midnight ride to warn about this, but the defaults are coming. Many are already here. They are coming from student loans given to the wrong students for the wrong reasons. The portfolio of federally guaranteed student loans passed the one trillion dollar mark in early 2012, and it […]

Read More

Until recently, much talk about student loans was fact-free: There simply weren’t publicly available figures worth paying attention to. The official balance of student loans from the NY Fed were unreliable: There was a bucket of random obligations called “Miscellaneous”, which included things like utility bills, child support, and alimony. And it turns out that […]

Read More

It’s called “the Bennett Hypothesis,” and it explains–or tries to explain–why the cost of college lies so tantalizingly out of reach for so many. In 1987, then Secretary of Education William J. Bennett launched a quarter century of debate by saying, in effect, “Federal aid doesn’t help; colleges and universities just cream off the extra […]

Read More

There’s something even worse than undergraduate debt. It’s graduate-school debt. According to the American Student Assistance website, which uses figures from such sources as the National Center for Education Statistics, the College Board, and the nonprofit Finaid.org, 60 percent of recipients of bachelor’s’ degrees borrowed to fund their education during the 2000s, with the average […]

Read More

When individuals seek higher education, why should all of us have to pay? After all, individuals decide whether to seek a college degree based on their own calculations of expected costs and benefits. That taxpayers must bear the burden of financial aid to these individuals seems unfair. Given the billions of dollars governments pay individuals […]

Read More

At Bloomberg News, Virginia Postrel writes about how federal subsidies intended to make college more affordable have instead encouraged rapidly rising tuitions, in a column entitled, “U.S. Universities Feast on Federal Student Aid.” Education analyst Neal McCluskey links to four studies showing that increased government spending on student aid results in large tuition increases. As […]

Read More

Sometimes the left is onto something. Take, for example, the latest twist in the “Occupy” movement: Occupy Student Debt. The new activism front, which began in with a Nov. 21 rally at Occupy Ground Zero, New York’s Zuccotti Park, is trying to collect a million online signatures from debtors pledging to refuse to repay their […]

Read More

The executive council of the Modern Language Association (MLA), the leading organization for English and foreign-language professors, issued a statement on Wednesday decrying the rising debt levels of college students. Well, sure, who isn’t against student debt? But I think that the MLA statement is more than just pious boilerplate. It’s a statement of panic–that […]

Read More

An elephant in the room that universities avoid is how their system is rigged to serve the rich over the poor. An October study by the American Enterprise Institute (AEI) entitled “Cheap for Whom?” showed one way that the university system is rigged in favor of the rich. It said: “Average taxpayers provide more in subsidies […]

Read More

The Income Based Repayment (IBR) program, which took effect in 2009, is designed to lighten the student-loan burden for some students. The basic idea is to limit monthly payments to less than 15% of disposable income. If a student makes these payments for 25 years, any remaining balance is forgiven, meaning that taxpayers essentially pay […]

Read More

Megan McArdle of the Atlantic, with a few strokes of her blog pen, has just solved the problem of too much student debt and the college affordability dilemma — all while ensuring access to higher education for those who truly deserve it. That is, for folks like herself. First, bowing to the widely circulated claim […]

Read More

In a recent essay in The Atlantic, Andrew Hacker and Claudia Dreifus lament that most students have to take out college loans. They write: “At colleges lacking rich endowments, budgeting is based on turning a generation of young people into debtors.” While Hacker and Dreifus blame the universities for encouraging students to take on more […]

Read More

The Center for College Affordability and Productivity has published an important report, “Faculty Productivity and Costs at the University of Texas at Austin,” based on data recently made available to the public, thanks to the efforts of reform-supporting regents at the UT system. Co-authored by Richard Vedder (the Ohio University economist), Christopher Matgouranis and Jonathan Robe, the report uses […]

Read More

By Andrew Gillen, Matthew Denhart, and Jonathan Robe As they defend tuition increases to irate students and parents, college and university leaders often argue that tuition does not cover their costs and that they are therefore subsidizing their students’ educations. Take, for example, what Southwestern College President Dick Merriman said in an October 2010 piece for The Chronicle of Higher […]

Read More

Today the Obama Administration unveiled its long-anticipated and highly controversial final gainful employment (GE) regulation that ties program eligibility for federal student aid to new metrics that are based on student loan repayment rates. Under the new GE rule, a vocational program can qualify as leading to gainful employment and remain eligible for federal aid […]

Read More

At the beginning of 2011 the portfolio of the federal government for education loans was nearly one trillion dollars. The portfolio consisted of loans for students currently in college extended either directly by the Department of Education or loans from financial institutions like Sallie Mae and banks with repayment guaranteed by the United States Treasury […]

Read More