Robert Reich, one of the left’s favorite economists, has long promoted public hysteria against tax rate cuts, peddling rage against the so-called “trickle-down” theory. Reich, who was trained in law, philosophy, politics, and economics at some of the world’s most prestigious institutions, including Oxford and Yale, recently reminded his 3.8 million followers on Facebook:

[T]rickle-down economics was invented by conservatives in the 1980s to justify massive tax cuts for the wealthy and corporations. It’s been nothing short of a disaster.

A preeminent public intellectual in the progressive orbit cannot be more wrong about the historical origins and intended mechanisms of federal tax-cut policies. By caricaturing a complex economic policy into a hate-inciting slogan of “tax cuts for the rich,” leftist academics have concocted a false narrative, not to earnestly engage their critics—whom they routinely compare to Hitler and the Ku Klux Klan—but to inflame social tension, polarize the issue and score political points.

In his new publication “Trickle Down” Theory and “Tax Cuts for the Rich,” Thomas Sowell insightfully confronts such dishonesty with literature and empirical evidence dating back to the 1920s. Sifting through classic economic textbooks, political speeches, congressional documents, and tax data, Sowell concludes that “trickle-down” is a non-existent theory not “found in even the most voluminous and learned histories of economic theories.” During the 1920s, Secretary of Treasurer Andrew Mellon under President Calvin Coolidge first advocated for reducing tax rates for high-income individuals on the ground that such measures could stop rampant capital flight into “tax shelters such as tax-exempt municipal bonds,” stimulate the private economy, and dramatically increase tax revenues. What happened upon Mellon’s proposal was immediate evidence against the “tax cuts for the rich” hysteria:

In 1921, when the tax rate on people making over $100,000 a year was 73 percent, the federal government collected a little over $700 million in income taxes, of which 30 percent was paid by those making over $100,000. By 1929, after a series of tax rate reductions had cut the tax rate to 24 percent on those making over $100,000, the federal government collected more than a billion dollars in income taxes, of which 65 percent was collected from those making over $100,000.

In fact, lowering tax rates so as to stimulate more tax-paying economic productivity and increase government revenues, the pronounced rationale behind the policy, was such an effective policy instrument that both political parties pursued it. Even the previous administration of Democratic President Woodrow Wilson understood the mechanism, with Wilson’s Treasury Secretary Carter Glass cautioning against tax rate hikes in 1919:

This process not only destroys a source of revenue to the Federal Government, but tends to withdraw the capital of very rich men from the development of new enterprises and place it at the disposal of State and municipal governments upon terms so easy to them … as to stimulate wasteful and nonproductive expenditure by State and municipal governments.

Even John Maynard Keynes, who gave supply-side economics of the government’s visible hand its intellectual ammunition, noted in 1933 that “given sufficient time to gather the fruits, a reduction of taxation will run a better chance, than an increase, of balancing the Budget.” Proponents of tax rate cuts also included President John F. Kennedy, President Ronald Reagan, and President George W. Bush, who cited the two previous presidents as successful precedents.

In short, statesmen across the political aisle defied the rhetorical smear campaign against the non-existent “trickle-down” economics because they were no more married to a zero-sum ideology of wealth distribution than to economic realities rooted in wealth creation. To put it simply, Wilson, Coolidge, Kennedy, Reagan, and Bush each did their math and decided that the “trickle-down” nonsense did not merit serious consideration.

The math is rather straightforward: under punishingly high tax rates, people possessing top incomes and footloose capital can easily park their money in tax-exempt bonds and securities, resulting in huge losses of tax revenues that cannot be made up by contributions from other taxpayers. Moreover, when fewer people are willing to invest their capital in the economy, labor force employment will also suffer, further shrinking government revenues. Again, in the late 1910s and throughout the 1920s, as Sowell observes:

There were 206 people who reported annual taxable incomes of one million dollars or more in 1916. But, as the tax rates rose, that number fell drastically, to just 21 people by 1921. Then, after a series of tax rate cuts during the 1920s, the number of individuals reporting taxable incomes of a million dollars or more rose again to 207 by 1925.25 Under these conditions, it should not be surprising that the government collected more tax revenue after tax rates were cut … [W]ith increased economic activity following the shift of vast sums of money from tax shelters into the productive economy, the annual unemployment rate from 1925 through 1928 ranged from a high of 4.2 percent to a low of 1.8 percent.

Sowell also tackles another favored dichotomy of the left, that somehow “tax cuts for the rich” always translate into higher tax burdens for the poor with hard data:

[B]oth the amount and the proportion of taxes paid by those whose net income was no higher than $25,000 went down between 1921 and 1929, while both the amount and the proportion of taxes paid by those whose net incomes were between $50,000 and $100,000 went up—and the amount and proportion of taxes paid by those whose net incomes were over $100,000 went up even more sharply.

One would ponder: there must be more academics and observers, not just contrarian Thomas Sowell, who is privy to such irrefutable evidence, particularly in this day and age. Then, why are the likes of Robert Reich, Paul Krugman, and other “reputable” scholars so intent on perpetuating a non-existent hypothesis, confusing the public “between reducing tax rates on individuals and reducing tax revenues received by the government?” Professor Sowell is more than generous in stating that it may be well-intentioned historians who relied on “unreliable peer consensus,” followed by zealous columnists and journalists who popularized the “trickle-down” delirium.

Amidst contemporary reiterations and regurgitations of the panic against “trickle-down,” from Barrack Obama to the self-anointed, anti-fascist/authoritarianist resistance after Trump’s return, the modern left continues to wage war against economic reality. Sadly, their seductive rhetoric continues to attract devoted followers and is ready to be proselytized to a young generation whose abysmal academic records surely make the task of ideological conversion easier. As Professor Sowell clarifies: “The facts are unmistakably plain, for those who bother to check the facts.”

Follow Wenyuan Wu on X.

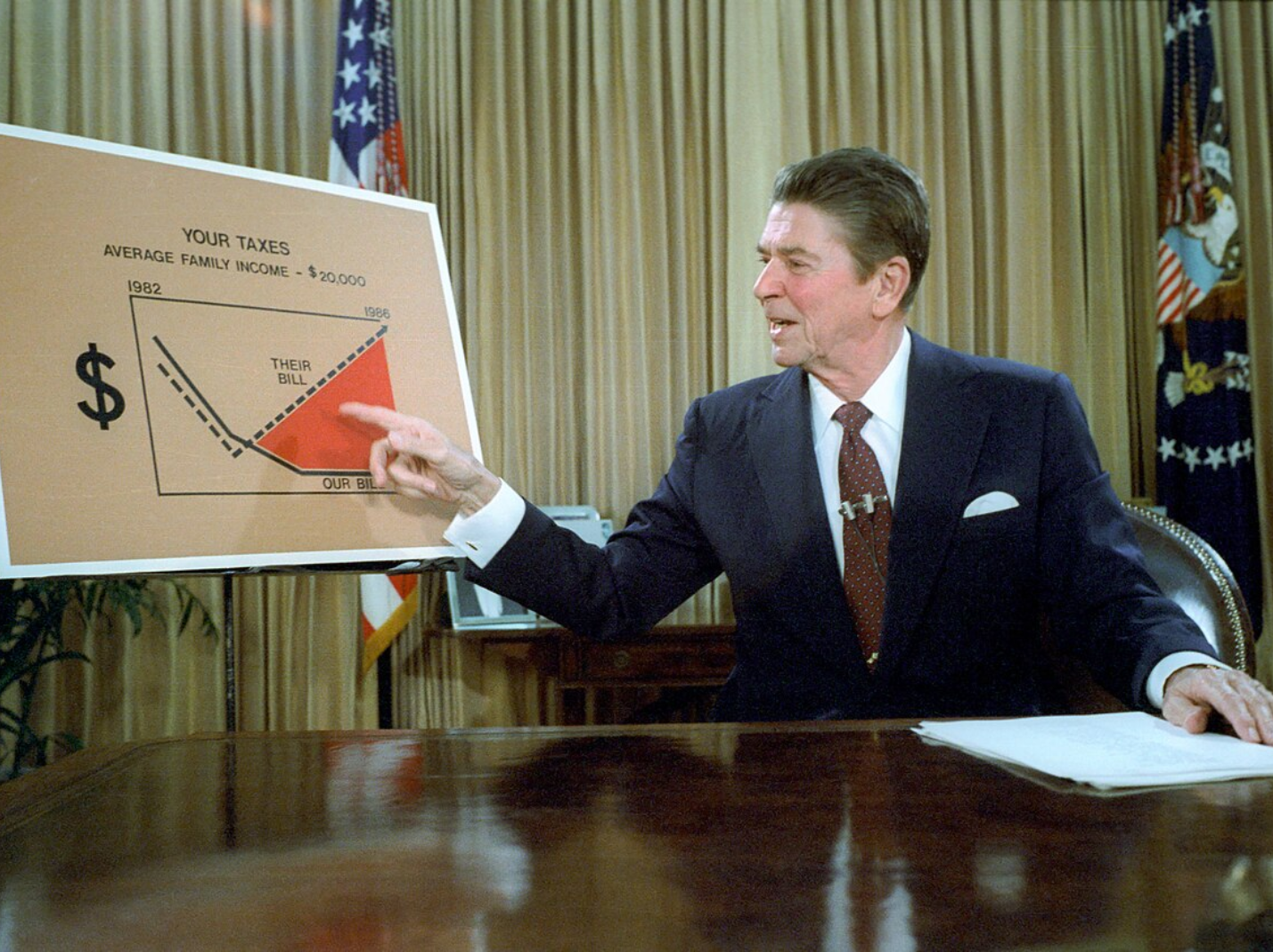

Image: “Ronald Reagan’s economic policies, dubbed “Reaganomics” by opponents, included large tax cuts and were characterized as trickle-down economics. In this picture, he is outlining his plan for the Economic Recovery Tax Act of 1981 from the Oval Office in a televised address, July 1981″ by White House Photographers on Wikipedia

James Grant has written an illuminating book on the Depression of 1921:

https://www.amazon.com/Forgotten-Depression-Crash-Cured-Itself/dp/1451686463/ref=sr_1_1?crid=2BDDL334JF945&dib=eyJ2IjoiMSJ9.eYO68Xg9KxZJqAnyhRX_Et5d2PC_d32nxcjxhnEwALlRwhr9mVq2zex4OL07V8pxZQYKvQHVA7jxQEge5HqtAX0YTs_S-wMm1aTRP6YKlCRcKwZvk5IgcFRD5xgd77R2X4upu9IBsi9R6-9W486Ld1b6jDH1baXP8fYSNC_et31iBDQAxnEORNXFZXGVRxTWYDMbxheMBJG6S6JMGXh2yzzi5iBSFd8T38ZtjfkkjBc.trlcvE7-h1tkolYYydtZTPW6us-a7f9i1A_72LzYmik&dib_tag=se&keywords=james+grant+1921&qid=1742508183&s=books&sprefix=james+grant+1921%2Cstripbooks%2C102&sr=1-1

Grant explains that it was over quickly because President Harding took good economic advice to cut the federal government’s spending and eliminated Wilson’s wartime controls. His “return to normalcy” was a return to our tradition of minimal government.

I have often wondered what would have happened had Coolidge run for re-election in 1928 — and the extent to which both Hoover and Roosevelt made things worse than they otherwise would have been.

It’s important to remember that only 16% of American households were in the stock market in 1929, it was the subsequent bank failures that really hurt Middle America, and that the New Deal arguably harmed way more than it helped.

My point was that you’ve got to include the Depression of 1921 if you are going compare 1921 to 1929.

A splendid article. The “trickle-down” line was invented by statists who want to convince people that government economic control is good and laissez-faire is bad. The truth is that income does not “trickle” down or up or sideways. It is earned. An economy where the state leaves the maximum resources in private hands gives everyone from the very rich to the very poor more opportunity to earn money. Conversely, the more the economy is controlled by the state, the less its limited resources are available for business purposes and the more are devoted to the things that rulers and politicians want. That means less opportunity to earn but great incentives to engage in political action to get the government to dole out the money it confiscates to those it favors. You necessarily get less output of marketable goods and services and more of what economists call rent seeking.

From https://www.princeton.edu/~starr/tnr-kris.html

>

Kristol’s description of his embrace of supply-side economics: “I was not certain of its economic merits but quickly saw its political possibilities.” You see, unlike traditional “naysaying” balanced-budget conservative economics, supply-side economics “offered neoconservatism” a way to give the voters the goodies they wanted. That supply-siderism could “offer” neoconservatism anything is a strange notion if one thinks of neoconservatism as a set of ideas, but not if one thinks of it as a partisan faction. In The Public Interest’s recent thirtieth anniversary issue, Kristol is also explicit about his own “cavalier attitude toward the budget deficit and other monetary or financial problems”: “political effectiveness was the priority, not the accounting deficiencies of government.”

<

The most obvious point to make is that this essay is a straw-man argument against critiques of "trickle down" (which is associated with supply-side but is conceptually different). The Laffer (should be laugher) curve ignores the regulatory and cultural environment, for example (one would have different curves under different regimes), and there is no basis for assuming it is convex, or that it can even be calculated. But the claim that supply-side tax cuts will pay for themselves has been consistently refuted by the Congression Budget Office, for example, or pretty much every economist (including Mankiw in his first edition of his text book, used the phrase "charlatans and cranks" to describe those who thought supply-side tax cuts would pay for themselves).

I think what is clear is that the economic policies of the last 50 years have resulted in an evisceration of the middle class (going from over 60% to under 50% by most studies). In particular, some analyses have shown that the economic returns to white high school graduates have not increased since 1969. This phenomenon is what lead to the rise of Donald Trump, since both political parties catered increasingly to those who have been more successful. Biden attempted to reverse this through the Inflation Reduction Act, and Trump is attempting to reverse this through tariffs, the point being, both parties now realize to some extent that the fading economic fortunes of the majority of Americans can very well lead to widespread social damage.

“In 1921, when the tax rate on people making over $100,000 a year was 73 percent, the federal government collected a little over $700 million in income taxes, of which 30 percent was paid by those making over $100,000. By 1929, after a series of tax rate reductions had cut the tax rate to 24 percent on those making over $100,000, the federal government collected more than a billion dollars in income taxes, of which 65 percent was collected from those making over $100,000.”

This neglects to take into account the Depression of 1920-21. https://en.wikipedia.org/wiki/Depression_of_1920%E2%80%931921

“From May 1920 to July 1921, automobile production declined by 60% and total industrial production by 30%. At the end of the recession, production quickly rebounded. Industrial production returned to its peak levels by October 1922. The AT&T Index of Industrial Productivity showed a decline of 29.4%, followed by an increase of 60.1%—by this measure, the recession of 1920–21 had the most severe decline and most robust recovery of any recession between 1899 and the Great Depression.”

It would be an interesting argument that tax rates exacerbated this, but it was largely caused by the end of the war, when there’s always a recession. There was one in the 1770s when what we call the “French & Indian War” ended — that’s the backstory of the runup to the Revolution.

It would also be interesting to see the extent to which the income of those above $100K increased and the extent to those in that bracket increased — it needs to be remembered that the vast majority of people did not pay income taxes until the 1940s, and that significant deflation would have reduced the number paying.