While student loans are a widely acknowledged problem, one program sticks out as particularly troublesome: the Grad PLUS program. After graduate students max out their traditional student loans, which include an annual and an aggregate borrowing limit, there is no limit to how much they can borrow through the Grad PLUS program.

Unsurprisingly, this has led to huge problems with Grad PLUS loans. With no limit on how much graduate students can borrow, it’s possible for them to accumulate over $1 million in student loans. This, incidentally, is one reason why student loan forgiveness is so misguided. Is it really the best use of taxpayer dollars to effectively give a financially irresponsible orthodontist in Utah $1 million? The contrast with undergraduate loan limits is stark—undergraduates cannot borrow more than $31,000 (for dependent undergraduates) to $57,500 (for independent undergraduates).

There are a variety of ways to address this problem (I’ve been pushing for credential- and academic field-specific debt limits), but perhaps the simplest is to just eliminate the Grad PLUS loan program.

I’m a big believer in the wisdom of Chesterton’s fence, which counsels that policies shouldn’t be changed or revoked without understanding why they were enacted in the first place. I’ve heard from several people directly involved in creating the program that Grad PLUS was not established in response to any real or perceived shortcomings of the traditional loan program. Rather, federal budget estimates at the time projected that Grad PLUS loans would be profitable for the government. Congress wanted to spend those profits elsewhere, so it established Grad PLUS and proceeded to spend the projected profits.

However, the projected profits never materialized. As noted previously, the Department of Education tends to overestimate repayments and use an inaccurate discount rate, leading to wild underestimates of the cost of student loans for taxpayers (to the tune of $645 billion over the past 25 years for undergraduate and graduate loans). One of the main reasons for this was that, shortly after Grad PLUS was established, new loan repayment plans were implemented. These plans dramatically reduced how much was repaid by many students, in part by tying payments to income (a good idea) and in part by forgiving any remaining balance after 10 to 25 years, depending on the program (a bad idea).

The bottom line is that the original justification for the Grad PLUS program—to raise money for Congress to spend elsewhere—was probably wrong at the time, was certainly wrong in retrospect, and is currently 180 degrees wrong. Grad PLUS costs the government money, likely around 31–37 cents for every dollar lent. Around $12 billion is borrowed under the Grad PLUS program each year, which means taxpayers are losing up to $4.4 billion per year. And if the Biden administration’s new loan repayment plan goes into effect, these losses would balloon. Thus, eliminating Grad PLUS would save taxpayers substantial amounts of money.

[More from Andrew Gillen: “The Right Is Not the Aggressor on Accreditation”]

But even more important would be the effects for student borrowers. If Grad PLUS was eliminated, graduate students would only be able to borrow from the standard student loan program (called Stafford Loans or Direct Loans). Under this program, graduate students would be limited to borrowing $20,500 per year. For reference, annual borrowing for a junior or senior undergraduate is $7,500 for dependent students and $12,500 for independent students. The aggregate limit for graduate students (including their undergraduate debt) is $138,500.

Personal finance experts recommend that students do not borrow more than their expected starting salary. Since very few students will have a starting salary anywhere near $138,500, this means that the aggregate limit is too high for most students. But interestingly, it is the annual limit, not the aggregate limit, that would better constrain borrowing.

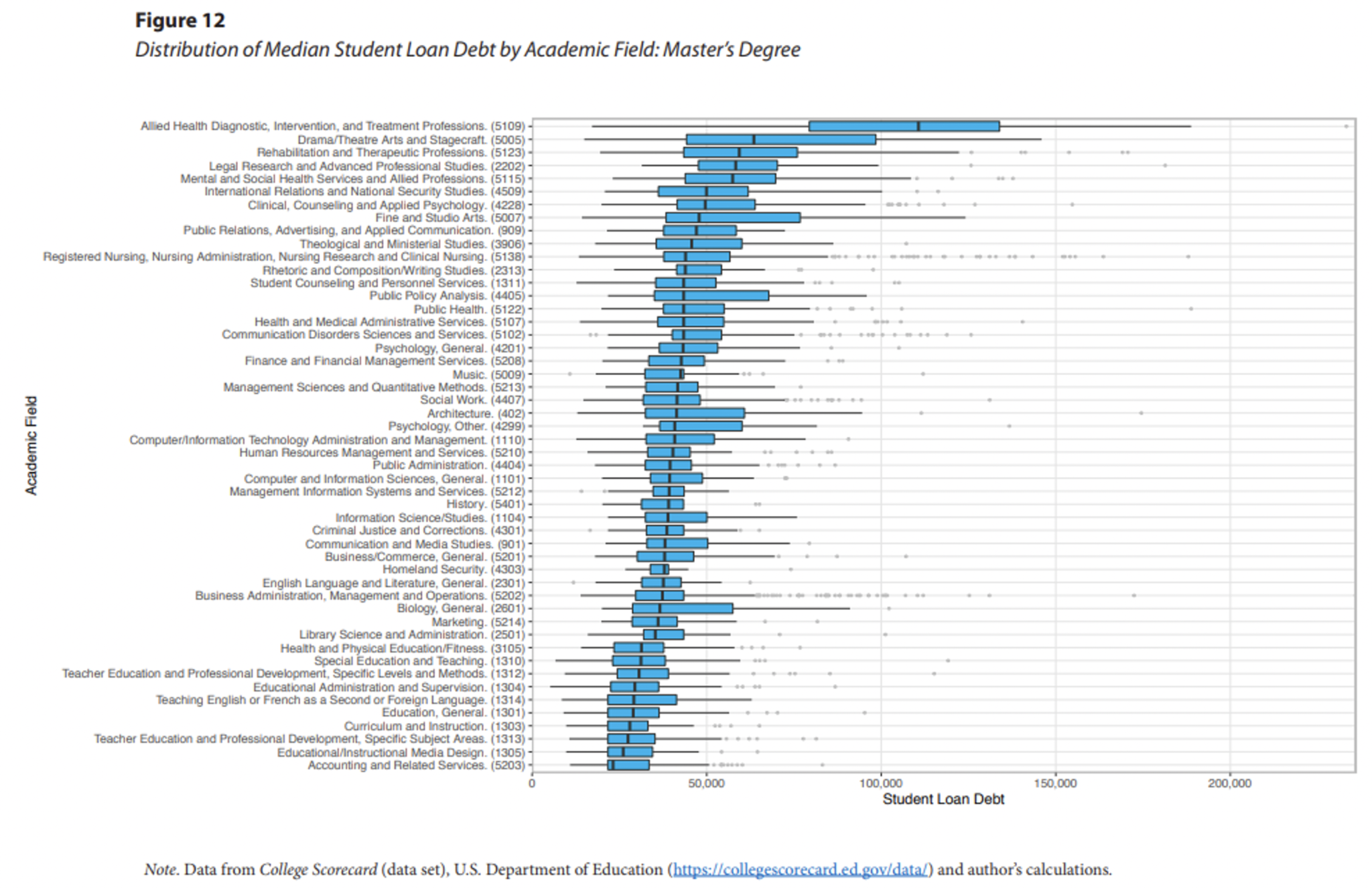

Consider graduates with a master’s degree. The typical early-career salary for graduates with a master’s degree is around $61,000, so the existing debt limit is more than twice as high as their recommended borrowing limit. But the annual borrowing limit would significantly reduce borrowing. With Grad PLUS, the typical debt (not counting undergraduate debt) for master’s degree graduates is around $43,000. But a student attending a two-year master’s degree program with an annual borrowing limit of $20,500 would only be able to borrow $41,000, a bit less than the current typical borrowing. While this may not seem like much, keep in mind that these are population-wide values. As the figure below (reproduced from here) shows, while median debt is around $43,000, there are hundreds of master’s degree programs with much higher median debt.

The effect is different for professional degrees. Typical earnings for graduates with a professional degree are around $78,000. But the typical debt is $168,000, which is substantially higher than the $138,500 limit. Moreover, the annual limit would be binding as well. Students in a two-year program would only be able to borrow $41,000, and even in a four-year program, they would only be able to borrow $82,000. Thus, many professional degree programs would need to dramatically limit borrowing if Grad PLUS was eliminated.

In sum, eliminating Grad PLUS would be an improvement over the status quo. The initial justification for the program never panned out and is certainly not true today. Far from turning a profit for the government, Grad PLUS results in losses, so eliminating the program would save taxpayers money. Relatively few students would be affected because the standard loans are sufficient for most students and most programs. Out of over three million graduate students, only around 430,000 take out Grad PLUS loans. The only programs that would be negatively affected are those where students borrow more than $20,500 a year or $138,500 in total.

Without the Grad PLUS program, students would be less likely to enroll or would rely on private borrowing; colleges and universities would have to reduce tuition and other costs. Any of these options are superior to continuing with the deeply problematic Grad PLUS program, which saddles both students and taxpayers with high costs.

Image: Adobe Stock

So this would prevent future doctors, mental health professionals, vets. etc from borrowing if they are maxed out or choose to change fields. This would not work. Lowering tuition would be a better option.

This is not an issue of supply and demand. The higher wages paid engineers in Cupertino, CA won’t have any affect on engineering wages in Billings, MT. No relationship whatsoever. It’s not free market forces or the desire by companies to attract talent that cause the wage difference; it’s cost of living. Cupertino is in the silicon valley area. Regular gas there is $4.80 a gallon. It’s $3.50 a gallon in Billings. Average apartment in Cupertino costs $2860 per month while only $1345 in Billings.

A student should be allowed to borrow as much as they want for their education—so long as the taxpayers are in no way obligated to repay any of that debt for them.

well but that suggests there is a magic third option. Either the student pays, or they don’t, in which case guess who is left holding the bag? The taxpayer. saying they can borrow as much as they want is akin to a bank saying you can take out as large a mortgage as you want as long as the bank is not left holding the bag. But of course the bank WILL be left holding the bag if they don’t make a reasonable assessment of your capacity to pay the loan back. These loans should be tied much more sensibly to probable future earnings.

Tying loans to probable future earnings will never work because there is no way to compute, estimate or guess future earnings. An engineer with 4 or 5 years experience working in Cupertino, CA will make a six figure salary. That same engineer working in Billings, MT won’t make anywhere near that. So where should the bank assume the future engineer will be working?

There *is* a magic third option — the university is left holding the bag.

The analogy to mortgages is good, but remember that there is also title insurance so that the bank doesn’t get stuck if there is a problem with the title, and home inspectors so the bank doesn’t get stuck if the home is uninhabitable, and a whole bunch of other stuff that you really need a lawyer to sort through.

I propose the same thing for student loans — which are guaranteed by the earning potential of the student, much as a mortgage is guaranteed by the value of the home.

1: Prosecute universities for fraudulent and deceptive advertising. They all advertise on the basis of their most successful graduates without ever mentioning how many of their graduates are working for minimum wage somewhere.

2: Establish the median (not mean) starting salary for every graduate program, as well as the percentage of graduates employed in that field six months after graduation.

3: Require all universities to purchase default insurance for every student that doesn’t repay the entire loan.

“An engineer with 4 or 5 years experience working in Cupertino, CA will make a six figure salary. That same engineer working in Billings, MT won’t make anywhere near that.”

I don’t know the relative wages of engineers, but can’t help but think that such a wage difference in a free market would draw talent to Cupertino and hence create a shortage of it in Billings, thus driving up wages there.

Now there likely are significant differences in the cost of living, but such differences would have to be included in the calculation of discretionary income, and hence the actual “income” upon which repayment is based.

Hence, in theory, both engineers would have the same discretionary income.

Now as to California making it difficult for out-of-state engineers to move to California so as to keep the wages of engineers high, that’s another issue…