School is back in session but not much has changed in the world of higher education. Tuition continues to become less affordable, student debt continues to rise, and students increasingly face poor career prospects. Also resuming is the barrage of policy proposals claiming to offer silver-bullet solutions to all that ails higher education.

The latest idea to make news headlines is a plan to force institutions with endowment assets exceeding $100 million to spend at least 8% of their assets each year. Writing for the New York Times, Victor Fleischer claims that under his proposal, “the sky-high tuition increases would stop, and maybe even reverse themselves. Faculty members would benefit from greater research support. University libraries, museums, hospitals and laboratories would have better facilities…Only fund managers would be worse off.”

Not Every Campus Is Yale or Harvard

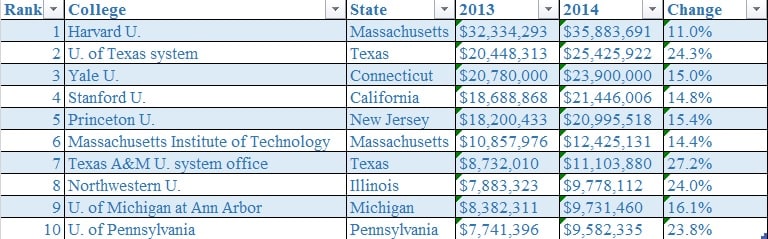

While institutions such as Yale, Harvard, MIT, Princeton and Stanford are very richly endowed, with assets topping $10 billion apiece, most institutions are not nearly as financially blessed.

According to IPEDS data, only 397 universities with an undergraduate enrollment of at least 1,000 students had an endowment exceeding $100 million at the end of FY2013. While the average endowment among these schools is nearly $1 billion, two-thirds of the institutions had assets of $500 million or less, and the vast majority (81.6%) had assets under $1 billion.

While these may sound like sufficient sums to fund utopian transformations of campuses, recall that the plan would only require institutions to spend 8% of their endowment annually. This would amounts to an average of more $13,000 per undergraduate student enrolled at these institutions. Viewed in this light, mandatory endowment spending could significantly reduce tuition and/or enhance the quality of education and knowledge discovery.

The distribution of endowment assets is highly skewed, however. Among the 324 institutions with an endowment below $1 billion, the 8% spending requirement would provide, on average, an additional $6,200 per undergraduate student. For institutions with an endowment under $500 million, it would amount to around $5,000 per undergraduate. These are still significant figures, but for more than 10% of the schools subject to the policy, it would amount to less than $1,000 per undergraduate. Institutions such as University of Central Florida, Miami Dada College, and Liberty University would only have about $200 per undergraduate.

Not a Panacea

While coercing universities to spend 8% of their endowments annually would boost university operating budgets significantly, on average, doing so is not a panacea.

Under the rule, the most richly endowed universities would be forced to spend more, but these institutions already have highly paid faculty and staff, top-notch facilities, and charmingly elegant campuses. And judging by the demand for admission to these institutions, they should arguably increase their tuition instead of lowering it. Furthermore, these elite universities are hardly those that policymakers and the general public have in mind when considering policies aimed at improving quality and making college more affordable.

As described above, many institutions subject to the rule would derive less than $1,000 per student under the policy. This would hardly be sufficient to implement the game-changing tuition reductions and other improvements prophesied. Furthermore, private foundations are only required to spend 5% of their endowment assets annually, so why should universities be subject to a higher rate? Thus, any policy change in this direction would likely generate a significantly smaller increase in operating budgets than reflected in the above estimates.

Unintended Consequences

Mandatory endowment spending would undoubtedly enhance short-term operation budgets, but it would also generate a number of unintended and potentially undesirable long-run consequences. Looking beyond the less-than-full pot of gold at the end of the rainbow, there are a number of reasons that an endowment spending mandate is bad news.

First, we should not expect that the operational budget enhancements would be utilized to control or lower tuition. When provided with additional revenues, universities have no problem spending the money on things that neither enhance educational quality nor make college more affordable. Witness the increasing bureaucratization of universities and the transformation of college campuses into country clubs, attributable in large part to the rapid growth of federal student assistance programs. Intended to make college more affordable, federal aid has instead driven up the cost of college, as confirmed in a recent study by Federal Reserve Bank economists. Transferring endowment resources to university administrators will likely yield a similar result –profligate spending that drives up the cost of college.

Donors increasingly take caution to ensure that their gifts are utilized in a manner that they desire. Major gifts are often designated to perpetually fund student scholarships, faculty chairs, or educational programs. The spending mandate would violate the intent of many donors who gave generously in order to provide a long-term revenue stream for such programs. Spending down such designated gifts would not only undermine the long-run solvency of endowed programs, but it would constitute the violation of a slew of (at least implicit) contracts.

A barrage of lawsuits is likely to follow in the wake of the widespread violations of donor intent. This would entangle both university and private resources in expensive litigation, diverting resources that could otherwise be available to fund scholarships and invest in other educational programs.

Such a policy would also create uncertainty on the part of prospective and future donors concerning the use of their philanthropic gifts, potentially increasing the degree of caution that philanthropists take before gifting their assets. Thus an endowment spending mandate would undermine the development efforts of many institutions, making it more costly to raise funds from private donors.

If You Can’t Beat ‘em, Tax ‘em

Responding to Fleischer, Alexander Holt indicates that “universities seem to be acting very similarly to corporations, and his solution is to force them to act less like one….Colleges act like corporations and they should be treated as such.” In other words, Holt suggests that universities are engaged in many of the same ventures as tax-paying private enterprises, and as such they should be subject to the corporate income tax. This is not a new idea, but it is a good one, particularly for well-established institutions highly invested in ventures traditionally operated by tax-paying businesses. Such university ventures should be subject to the same tax rules as the businesses that compete with them. We should also consider limiting the tax deductibility of university gifts to those designated for scholarships and research and educational programs. But forced endowment spending, No.

Mandatory endowment spending is a horrible idea, for many reasons, not least, the violation of the intent of most donors (who are quite able to give money to current expenditures if they so desire).

For the schools where it would make a big difference — the Harvards of the world — tuition is not really a problem, because most students get very generous financial aid, and those who come from families wealthy enough to pay full tuition, the actual educational expenditure is far higher than what they actually pay.